As of the 2018 tax year itemized deductions for job related expenses or other miscellaneous expenses outlined below that exceeded 2 of your income have been suspended.

Miscellaneous itemized deductions floor.

Specifically the tcja suspended for 2018 through 2025 a large group of deductions lumped together in a category called miscellaneous itemized deductions that were deductible to the extent they exceeded 2 of a taxpayer s adjusted gross income.

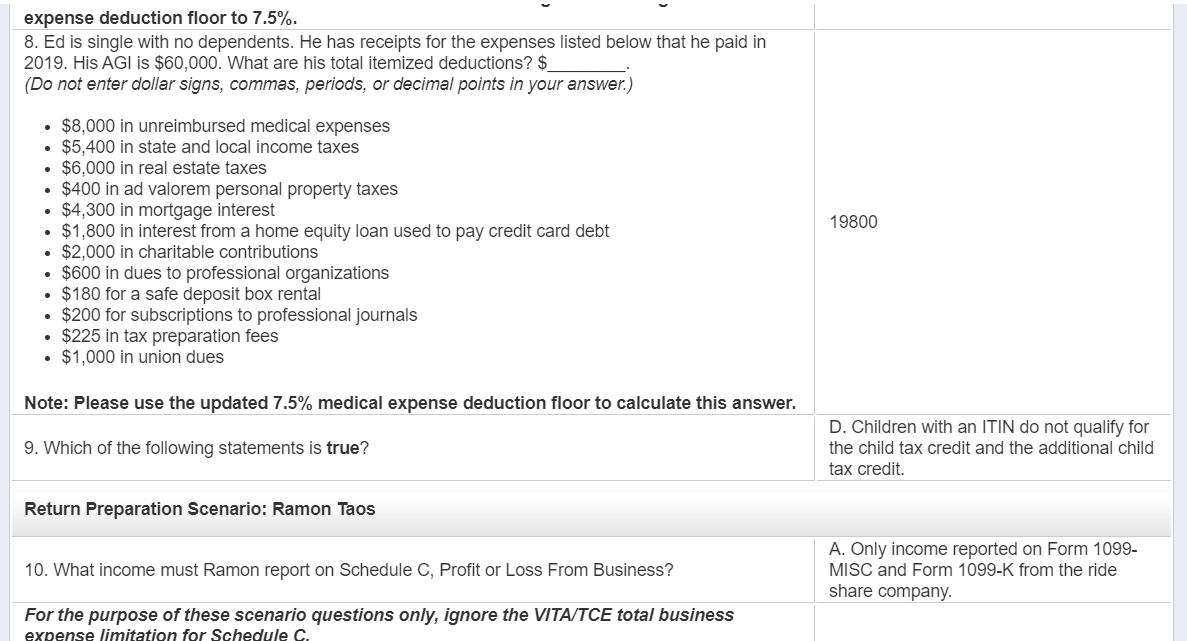

For tax years previous to 2018 if you itemize your deductions part of the expenses that you claim as deductions may be limited by the 2 rule deductions that are included are unreimbursed employee expenses expenses.

Form 1040ez is generally used by single married taxpayers with taxable income under 100 000 no dependents no itemized deductions and certain types of income including wages salaries tips taxable scholarships or fellowship grants and unemployment compensation.

Expenses that exceed 2 of your federal agi.

With respect to individuals section 67 disallows deductions for miscellaneous itemized deductions as defined in paragraph b of this section in computing taxable income i e so called below the line deductions to the extent that such otherwise allowable deductions do not exceed 2 percent of the individual s adjusted gross.

For tax years prior to 2018 you can only claim miscellaneous deductions on your tax return if you itemize this occurs when the total of your itemized deductions is greater than your standard deduction and you file a schedule a reporting the itemized deduction amount.

Prev next a general rule.

Tcja the new tax code suspended investment fees and expenses along with all other miscellaneous itemized deductions subject to the 2 floor.

These include the following deductions.

Unreimbursed employee business expenses such as.

All deductions for expenses incurred in carrying out wagering transactions and not just gambling losses are limited to the extent of gambling.

Gambling losses are deductible to the extent of gambling winnings.

You can still claim certain expenses as itemized deductions on schedule a form 1040 1040 sr or 1040 nr or as an adjustment to income on form 1040 or 1040 sr.

A type of expenses subject to the floor 1 in general.

Deductible expenses subject to the 2 floor includes.

Starting on january 1 2018 and running through december 31 2026 individuals will no longer have the ability to deduct the excess expenses listed below as itemized deductions on their 1040s.

This publication covers the following topics.

In the case of an individual the miscellaneous itemized deductions for any taxable year shall be allowed only to the extent that the aggregate of such deductions exceeds 2 percent of adjusted gross income.

These are work related.

2 percent floor on miscellaneous itemized deductions.

Miscellaneous itemized deductions are those deductions that would have been subject to the 2 of adjusted gross income limitation.

Job expenses and certain miscellaneous itemized deductions.

Two itemized deductions for investors survived tax.